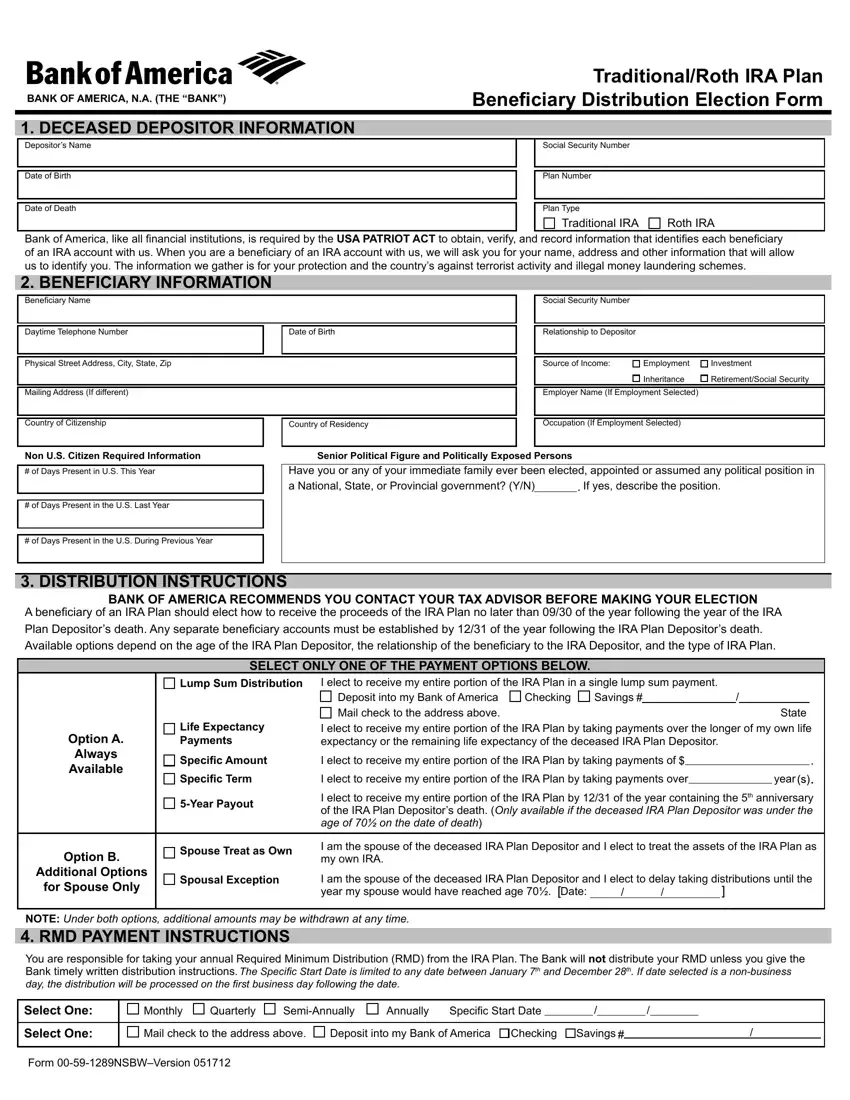

BANK OF AMERICA, N.A. (THE “BANK”)

Traditional/Roth IRA Plan

Beneficiary Distribution Election Form

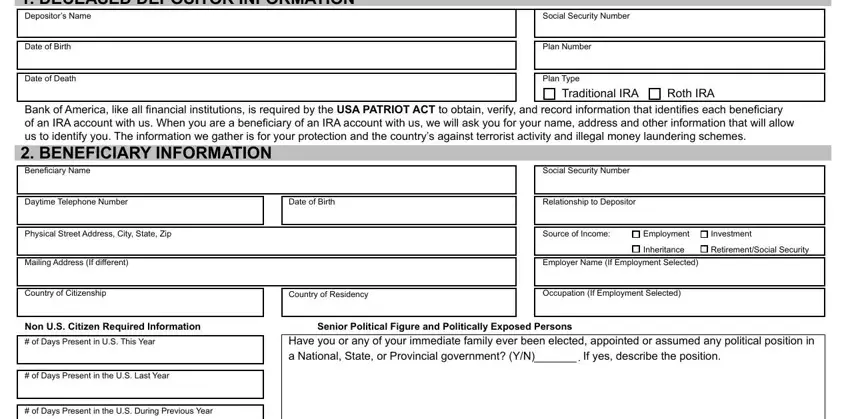

1. DECEASED DEPOSITOR INFORMATION

Depositor’s Name

Date of Birth

Date of Death

Social Security Number

Plan Number

Plan Type

Traditional IRA

Roth IRA

Roth IRA

Bank of America, like all financial institutions, is required by the USA PATRIOT ACT to obtain, verify, and record information that identifies each beneficiary of an IRA account with us. When you are a beneficiary of an IRA account with us, we will ask you for your name, address and other information that will allow us to identify you. The information we gather is for your protection and the country’s against terrorist activity and illegal money laundering schemes.

2. BENEFICIARY INFORMATION

Beneficiary Name

Daytime Telephone Number |

|

Date of Birth |

|

|

|

|

|

|

Physical Street Address, City, State, Zip |

|

|

|

|

|

|

|

|

Mailing Address (If different) |

|

|

|

|

|

|

|

|

Country of Citizenship |

|

Country of Residency |

|

|

|

Social Security Number

Relationship to Depositor

Source of Income: |

Employment |

Investment |

|

Inheritance |

Retirement/Social Security |

|

|

|

Employer Name (If Employment Selected) |

|

|

|

|

Occupation (If Employment Selected)

Non U.S. Citizen Required Information

#of Days Present in U.S. This Year

#of Days Present in the U.S. Last Year

#of Days Present in the U.S. During Previous Year

Senior Political Figure and Politically Exposed Persons

Have you or any of your immediate family ever been elected, appointed or assumed any political position in

a National, State, or Provincial government? (Y/N) |

|

If yes, describe the position. |

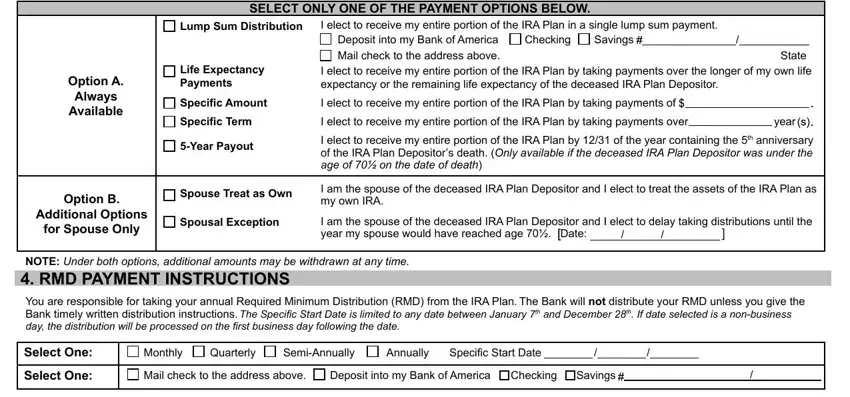

3. DISTRIBUTION INSTRUCTIONS

BANK OF AMERICA RECOMMENDS YOU CONTACT YOUR TAX ADVISOR BEFORE MAKING YOUR ELECTION

A beneficiary of an IRA Plan should elect how to receive the proceeds of the IRA Plan no later than 09/30 of the year following the year of the IRA Plan Depositor’s death. Any separate beneficiary accounts must be established by 12/31 of the year following the IRA Plan Depositor’s death. Available options depend on the age of the IRA Plan Depositor, the relationship of the beneficiary to the IRA Depositor, and the type of IRA Plan.

SELECT ONLY ONE OF THE PAYMENT OPTIONS BELOW.

Lump Sum Distribution I elect to receive my entire portion of the IRA Plan in a single lump sum payment.

Lump Sum Distribution I elect to receive my entire portion of the IRA Plan in a single lump sum payment.

|

|

|

Deposit into my Bank of America |

Checking |

Savings |

|

|

|

|

|

|

|

Life Expectancy |

Mail check to the address above. |

|

|

|

|

|

|

|

|

State |

|

Option A. |

I elect to receive my entire portion of the IRA Plan by taking payments over the longer of my own life |

|

Payments |

expectancy or the remaining life expectancy of the deceased IRA Plan Depositor. |

|

|

|

|

|

Always |

Specific Amount |

I elect to receive my entire portion of the IRA Plan by taking payments of |

|

|

|

|

|

|

Available |

|

|

|

|

|

Specific Term |

I elect to receive my entire portion of the IRA Plan by taking payments over |

|

|

|

|

year |

|

|

|

|

|

|

|

|

5-Year Payout |

I elect to receive my entire portion of the IRA Plan by 12/31 of the year containing the 5th anniversary |

|

|

of the IRA Plan Depositor’s death. (Only available if the deceased IRA Plan Depositor was under the |

|

|

|

|

|

|

age of 70½ on the date of death) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option B. |

Spouse Treat as Own |

I am the spouse of the deceased IRA Plan Depositor and I elect to treat the assets of the IRA Plan as |

|

my own IRA. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Options |

Spousal Exception |

I am the spouse of the deceased IRA Plan Depositor and I elect to delay taking distributions until the |

|

for Spouse Only |

|

|

year my spouse would have reached age 70½. Date: |

|

|

|

|

|

|

|

|

|

NOTE: Under both options, additional amounts may be withdrawn at any time.

4. RMD PAYMENT INSTRUCTIONS

You are responsible for taking your annual Required Minimum Distribution (RMD) from the IRA Plan. The Bank will not distribute your RMD unless you give the Bank timely written distribution instructions. The Specific Start Date is limited to any date between January 7th and December 28th. If date selected is a non-business day, the distribution will be processed on the first business day following the date.

Select One: |

Monthly |

Quarterly |

Semi-Annually |

Annually |

Specific Start Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select One: |

Mail check to the address above. |

Deposit into my Bank of America |

Checking |

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 00-59-1289NSBW–Version 051712

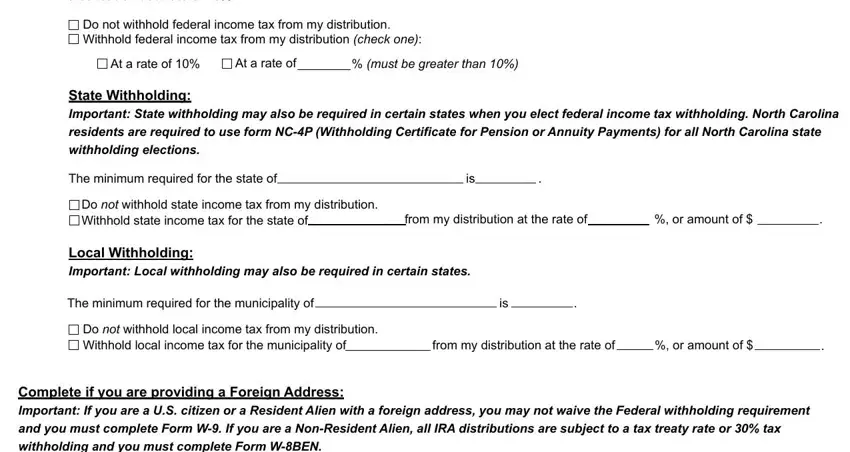

5. TAX WITHHOLDING ELECTION

Notice of Withholding Election: Distributions you receive from your Individual Retirement Account are subject to Federal income tax withholding and may be subject to State income tax withholding and/or Local income tax withholding based on your state and municipality of residence unless you elect not to have withholding apply.

You are liable for Federal, and applicable State and Local income taxes on the taxable portion of your distribution. If you elect not to have withholding apply to your distribution, or if you do not have enough tax withheld from your distribution, you may be responsible for payment of estimated taxes. You may also incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient.

Withholding Election: You MUST indicate your withholding election below.

Complete if you are providing a U.S. Address:

Federal Withholding:

Important: Please note that if you do not make a withholding election, federal income tax will be automatically withheld from your distribution at a rate of 10%.

Do not withhold federal income tax from my distribution.

Do not withhold federal income tax from my distribution.

Withhold federal income tax from my distribution (check one):

Withhold federal income tax from my distribution (check one):

At a rate of 10% |

At a rate of |

|

% (must be greater than 10%) |

State Withholding:

Important: State withholding may also be required in certain states when you elect federal income tax withholding. North Carolina residents are required to use form NC-4P (Withholding Certificate for Pension or Annuity Payments) for all North Carolina state withholding elections.

The minimum required for the state of |

|

|

|

is |

|

. |

|

|

|

|

Do not withhold state income tax from my distribution. |

from my distribution at the rate of |

|

%, or amount of $ |

|

. |

Withhold state income tax for the state of |

|

|

|

Local Withholding:

Important: Local withholding may also be required in certain states.

The minimum required for the municipality of |

|

|

|

is |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

Do not withhold local income tax from my distribution. |

|

|

|

|

|

|

|

|

Withhold local income tax for the municipality of |

|

from my distribution at the rate of |

|

%, or amount of $ |

|

. |

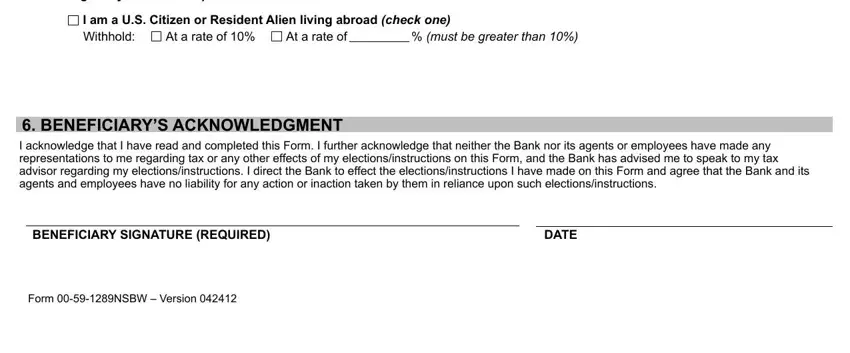

Complete if you are providing a Foreign Address:

Important: If you are a U.S. citizen or a Resident Alien with a foreign address, you may not waive the Federal withholding requirement and you must complete Form W-9. If you are a Non-Resident Alien, all IRA distributions are subject to a tax treaty rate or 30% tax withholding and you must complete Form W-8BEN.

I am a U.S. Citizen or Resident Alien living abroad (check one)

I am a U.S. Citizen or Resident Alien living abroad (check one)

Withhold: |

At a rate of 10% |

At a rate of |

|

% (must be greater than 10%) |

6. BENEFICIARY’S ACKNOWLEDGMENT

I acknowledge that I have read and completed this Form. I further acknowledge that neither the Bank nor its agents or employees have made any representations to me regarding tax or any other effects of my elections/instructions on this Form, and the Bank has advised me to speak to my tax advisor regarding my elections/instructions. I direct the Bank to effect the elections/instructions I have made on this Form and agree that the Bank and its agents and employees have no liability for any action or inaction taken by them in reliance upon such elections/instructions.

BENEFICIARY SIGNATURE (REQUIRED) |

|

DATE |

Form 00-59-1289NSBW – Version 042412

BANK OF AMERICA, N.A. (THE “BANK”)

Traditional/Roth IRA Plan

Beneficiary Distribution Election Form

Informational Sheet

BANK OF AMERICA RECOMMENDS YOU CONTACT YOUR TAX ADVISOR BEFORE MAKING YOUR ELECTION

A beneficiary of an IRA Plan should elect how to receive the proceeds of the IRA Plan no later than 09/30 of the year following the year of the IRA Plan Depositor’s death. Any separate beneficiary accounts must be established by 12/31 of the year following the IRA Plan Depositor’s death. Available options depend on the age of the IRA Plan Depositor, the relationship of the beneficiary to the IRA Depositor, and the type of IRA Plan.

Complete, sign and send the distribution form:

To your Local Bank of America Banking Center

Or, mail to the following address:

Bank of America, N.A.

Mail code: TX2-979-02-14

P.O. Box 619040

Dallas, TX 75261-9943

1. DECEASED DEPOSITOR INFORMATION

Depositor’s Name — Enter the deceased person’s name

Social Security Number — Enter the deceased person’s social security number

Date of Birth — Enter the deceased person’s Date of Birth

Plan Number — Enter the deceased person’s Plan Number that is being processed

Date of Death — Enter the date of death for the account owner (deceased person

Plan type — Select the plan type of the deceased account holder

2. BENEFICIARY INFORMATION

Bank of America, like all financial institutions, is required by the USA PATRIOT ACT to obtain, verify, and record information that identifies each beneficiary of an IRA account with us. When you are a beneficiary of an IRA account with us, we will ask you for your name, address and other information that will allow us to identify you. The information we gather is for your protection and the country’s against terrorist activity and illegal money laundering schemes.

Beneficiary Name — Enter the name of the beneficiary for the plan identified in the Plan Number section

Social Security Number — Enter the Social Security Number for the beneficiary listed in the Beneficiary Name section. If the beneficiary is an entity, enter the Employer Identification Number (EIN)

Daytime Telephone Number — Enter the best contact number that you can be reach at during the day

Date of Birth — Date of birth for the person listed in the Beneficiary Name section. If the beneficiary is an Entity, please list the Date of Birth for the decedent

Relationship to the Depositor — Example, Daughter, Mother, or Father. If the beneficiary is an Entity please leave this field blank

Physical Street Address, City, State, Zip — Enter the street address for the beneficiary listed in the Beneficiary Name section. Please note: This must be a physical address to comply with the USA Patriot ACT.

Source of Income — Select the appropriate option from the list provided. If the beneficiary is an Entity, please select Inheritance.

Mailing Address — Complete only if different from the Physical Address listed.

Employer Name — List the beneficiary’s current employer

Country of Citizenship — Enter the Country that the Beneficiary is a citizen

Country of Residency — Enter the Country the Beneficiary resides in

Occupation — Enter the Beneficiary’s current occupation or job ONLY if employment was selected as Source of Income

Non U. S. Citizen Required Information

of Days Present in the U.S. This Year — Enter the number of days that the beneficiary has been present in the U. S. for the current year

of Days Present in the U.S. This Year — Enter the number of days that the beneficiary has been present in the U. S. for the current year

of Days Present in the U.S. Last Year — Enter the number of days that the beneficiary was in the U.S. during the last calendar year

of Days Present in the U.S. Last Year — Enter the number of days that the beneficiary was in the U.S. during the last calendar year

of Days Present in the U.S. Prior to the Last Year — Enter the number of days that the beneficiary was in the U.S. Prior to the last full calendar year

of Days Present in the U.S. Prior to the Last Year — Enter the number of days that the beneficiary was in the U.S. Prior to the last full calendar year

Senior Political Figure and Politically Exposed Person

Indicate if you should be identified as a senior political figure or politically exposed person. Provide details on the position held or relationship.

3. DISTRIBUTION INSTRUCTIONS

Please ensure that you select only one of the payment options from the list. Selecting multiple options can delay the processing of your request.

Option A:

Lump Sum Distribution — Available to all beneficiaries. This option would be a single lump sum payment of the funds directly to the beneficiary

Life Expectancy — Payments would be made over the life expectancy of the beneficiary list in the Beneficiary Name section Specific Amount — Payment amounts would be disbursed as specified by the beneficiary (the beneficiary will be responsible to ensure that their disbursement amount meets IRS requirements)**

Specific Term — Payments will be disbursed over a specified term as elected by the beneficiary (the beneficiary will be responsible to ensure that their disbursement amount meets IRS requirements)**

5-year Payout — Payments will be disbursed by 12/31 of the 5th year post the year of death of the IRA Plan holder**

Option B (Spousal Options):

Spouse Treat as Own — An IRA plan honoring the deceased depositor’s existing IRA Plan terms would be established for the spouse, and the account would be treated as their own.

Spousal Exception — The spouse elects to delay taking distributions until the deceased account holder would have reached 70½

**Under these methods denoted above, additional amounts may be withdrawn at any time.

Please note: If you selected any option except Lump Sum, please ensure Section 4 is completed (if applicable).

4. RMD PAYMENT INSTRUCTIONS

The Beneficiary is responsible for taking their annual Required Minimum Distribution (RMD) from the IRA Plan. The Specific Start Date is limited to any date between January 7th and December 28th. If date selected is a non-business day, the distribution will be processed on the first business day following the date.

Please review the options carefully and select the appropriate distribution for the beneficiary.

5. TAX WITHHOLDING ELECTION

Notice of Withholding Election: Distributions you receive from your Individual Retirement Account are subject to Federal income tax withholding and may be subject to State income tax withholding and/or Local income tax withholding based on your state and municipality of residence unless you elect not to have withholding apply.

You are liable for Federal, and applicable State and Local income taxes on the taxable portion of your distribution. If you elect not to have withholding apply to your distribution, or if you do not have enough tax withheld from your distribution, you may be responsible for payment of estimated taxes. You may also incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient.

You MUST indicate your withholding election on the form provided.

Federal Withholding:

Important: Please note that if you do not make a withholding election, federal income tax will be automatically withheld from your distribution at a rate of 10%.

State Withholding:

Important: State withholding may also be required in certain states when you elect federal income tax withholding. Note that North Carolina residents must use Form NC-4P (Withholding Certificate for Pension or Annuity Payments) to elect or waive North Carolina state withholding.

Local Withholding:

Important: Local withholding may also be required in certain states.

Complete denoted section if you are providing a Foreign Address:

Important: If you are a U.S. citizen or a Resident Alien with a foreign address, you may not waive the Federal withholding requirement and you must complete Form W-9. If you are a Non-Resident Alien, all IRA distributions are subject to a tax treaty rate or 30% tax withholding and you must complete Form W-8BEN.

For additional questions, please contact your local Bank of America Banking Center or our customer service associates are available toll-free at 1.888.827.1812 to answer questions and provide additional information.

Roth IRA

Roth IRA

Do not withhold federal income tax from my distribution.

Do not withhold federal income tax from my distribution.

Withhold federal income tax from my distribution

Withhold federal income tax from my distribution

I am a U.S. Citizen or Resident Alien living abroad

I am a U.S. Citizen or Resident Alien living abroad